Cosmetics

High channels, retailers, and methods driving magnificence ecommerce

Magnificence and Private Care rank among the many hottest and fastest-growing eCommerce classes in Europe, with procuring traits evolving quickly resulting from financial shifts, technological improvements, and altering shopper values. To stay aggressive, manufacturers should strategically leverage first-party shopper information and undertake agile eCommerce methods like shoppable media.

The most recent benchmarks from the MikMak Procuring Index supply beneficial insights into the important thing drivers shaping Magnificence and Private Care eCommerce throughout Europe’s 5 largest markets: the UK, France, Germany, Spain, and Italy.

Meta leads however TikTok’s progress is shaking up Magnificence and Private Care social commerce

Meta platforms, Fb and Instagram, at the moment lead the social commerce visitors for multichannel shopper manufacturers on the MikMak platform by way of its shoppable media and where-to-buy options. Nonetheless, TikTok is shortly growing its impression.

In international evaluation between 2023 and 2024, MikMak information confirmed a ten p.c progress in model visitors on Meta, in comparison with a outstanding 190 p.c enhance on TikTok. Regardless of regulatory considerations, TikTok’s progress stays robust, significantly within the Magnificence and Private Care sectors, the place person engagement is surging.

In Q3 2024, TikTok outpaced Meta within the UK and France amongst Magnificence consumers, based mostly on Buy Intent Clicks, a MikMak metric measuring in-market shopper visitors to retailers. In the meantime, YouTube emerged as a big participant in Private Care, within the prime three rating of the quarter.

As shopper preferences evolve resulting from elements like demographics, product classes, and platform options, manufacturers should adapt their methods to optimize efficiency throughout a number of social platforms.

Amazon competes with specialised retailers for Magnificence and Private Care eCommerce visitors

Amazon continues to develop its presence within the Magnificence and Private Care sector. eMarketer attributes Amazon’s U.S. progress to strategic strikes like increasing premium model choices and internet hosting unique Magnificence gross sales occasions.

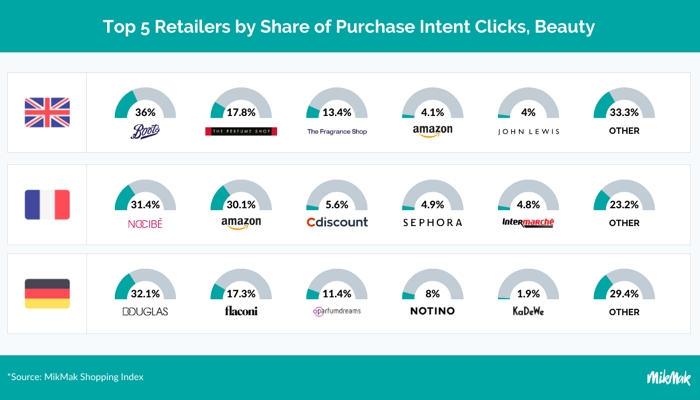

In Europe, Amazon has strengthened its place, particularly in Private Care. In France, Amazon additionally noticed a 9-percentage-point enhance in Magnificence shopper visitors in comparison with final yr, although it ceded the highest spot to specialised retailer Nocibé, among the many prime 5 retailers.

Regardless of Amazon’s rising affect, specialised retailers comparable to Boots within the UK, Nocibé in France, and Douglas in Germany stay robust, commanding over a 3rd of purchaser visitors throughout Europe.

What to anticipate for This fall and past

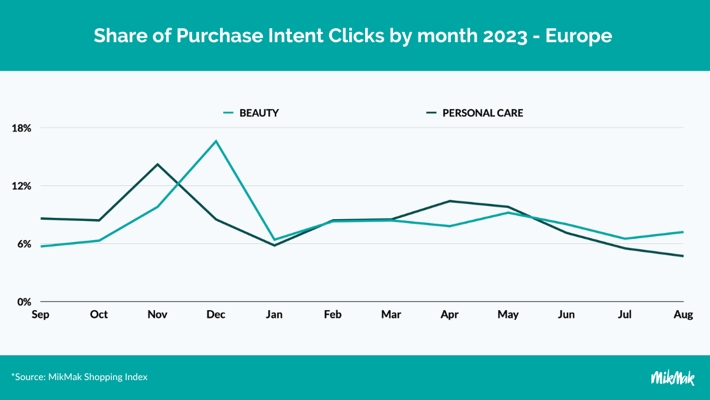

This fall was the strongest interval for Magnificence and Private Care manufacturers in Europe in 2023, with Private Care visitors peaking in November and Magnificence gross sales highest in December. On-line gross sales in these sectors are projected to develop by 10 p.c, signaling one other robust yr forward.

Nonetheless, rising residing prices are reshaping shopper habits, so manufacturers should intently observe information and optimize advertising and marketing methods to remain aggressive and drive worthwhile eCommerce progress. Listed below are a number of traits to observe:

– Premium vs Inexpensive

Consumers are balancing premium product enchantment with affordability, specializing in high quality elements whereas trying to find reductions, rewards, and “dupes”, inexpensive alternate options to luxurious gadgets. This development is particularly prevalent amongst Gen Z shoppers.

– Gen Z & TikTok

Gen Z turns to TikTok first for locating and evaluating manufacturers, adopted by Instagram, YouTube, and Fb. With this group driving conversations on affordability and product analysis, manufacturers should leverage these platforms to remain aggressive.

– Fragrances and particular magnificence care

Fragrances lead Magnificence shopper visitors in Europe, adopted by concealers, foundations, and the rising recognition of make-up introduction calendars. In Private Care, cleaning gels and specialty dermocosmetics for pores and skin and hair remedies are prime performers, with gadgets like anti-pigment serum displaying excessive buy intent.

– Shoppable media progress

We count on substantial progress in shoppable media promoting for Magnificence and Private Care manufacturers throughout Europe within the coming yr, fueled by rising digital advert spending and the growing want for manufacturers to optimize advertising and marketing profitability.

By successfully leveraging shoppable media and where-to-buy options, manufacturers can streamline the procuring expertise, making it simpler for shoppers to seek out and buy from their most well-liked retailers. With superior options comparable to MikMak, this strategy will allow manufacturers to maximise eCommerce alternatives and analyze advertising and marketing ROI by coherent and constant first-party information assortment throughout their digital media combine.

For extra insights, greatest practices, and case research, obtain MikMak’s newest information, The best way to Drive Magnificence & Private Care eCommerce in Europe.